Construction Costs: Will They Go Down?

In recent months, one of the most common questions we are asked by our clients is whether construction costs for new medical facilities will decrease in the near term. As many are aware, construction costs are at or near historical highs in Florida and throughout the United States for most asset classes, including medical office and ambulatory facilities.

While there is no crystal ball that can tell us exactly where costs may be headed, we can review historical trends to look for hints as to what we can expect in the future.

Historical View

General Inflation

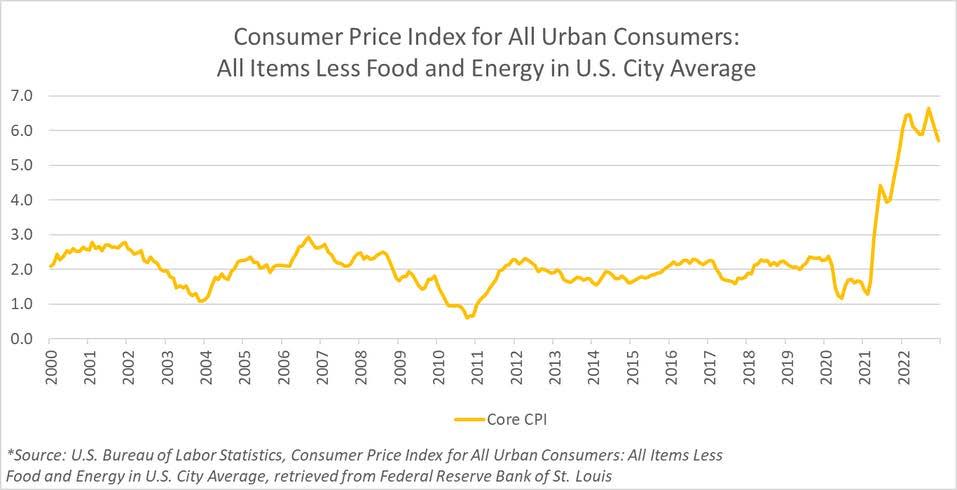

Before diving into industry specifics such as construction costs, land prices, and interest rates, we want to quickly touch on general inflation which is impacting all industries and citizens across the country.

The below chart reflects the Consumer Price Index for All Urban Consumers: All Items Less Food & Energy. This measurement, also known as “Core CPI,” is widely used by economists as a gauge of inflation. As the chart demonstrates, inflation has accelerated considerably since the beginning of 2021. And while many expect inflation to cool in the near term, it is important to point out that inflation is a measurement of how much the prices for goods and services have increased over time, not a reflection of the actual prices. So even if inflation is somehow reduced to 0% (the Federal Reserve is currently targeting 2% inflation with talks of increasing to 3%), that does not mean that prices will decrease. Of note, the “Core CPI” has never reached zero in the last 22 years, even during the Great Financial Crisis of 2007-2008.

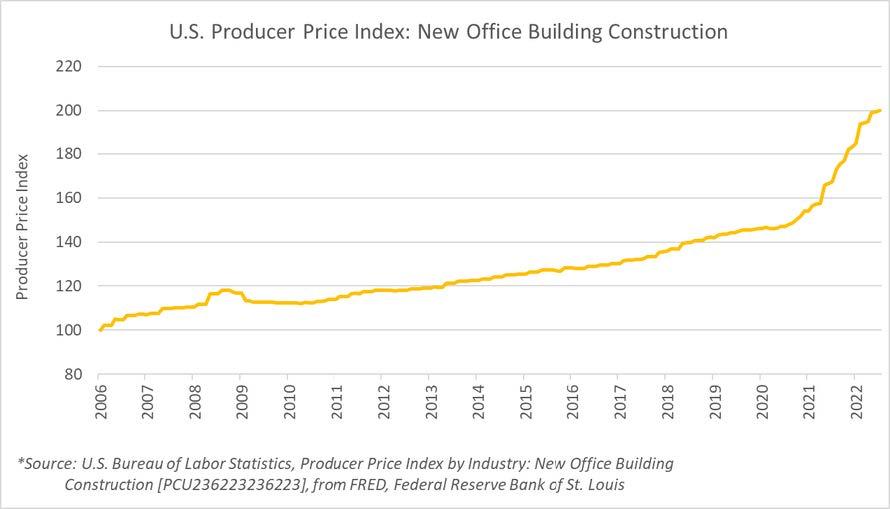

Construction Costs

Unfortunately, construction costs are not immune to the effects of inflation and the below chart helps to illustrate the dramatic acceleration of costs in recent years. The data is provided by the U.S. Bureau of Labor Statistics and reflects the Producer Price Index for New Office Construction throughout the United States from 2006 through 2022.

For anyone considering a new project, it is fair to wonder if costs will come back down to previous levels. However, reviewing the period from 2006 through the Great Financial Crisis of 2007-2008 suggests that may be wishful thinking. Prices were already accelerating in 2006 and increased by approximately 20% in the less than three years that followed. Although we experienced one of the greatest financial shocks of our lifetimes, prices still did not return anywhere near the levels they were in 2006 and remained resilient throughout the crisis. This can be attributed to a variety of factors, but it is important to point out that once prices are set for a certain trade, service, material, etc., vendors rarely reduce those prices on a go forward basis.

Additionally, when construction slows due to economic stress, it often coincides with unwelcome consequences that create additional burdens in delivering a facility. For example, during the Great Financial Crisis of 2007-2008, a large portion of the labor pool in Florida was relocated to Texas and elsewhere in search of more consistent and higher paying jobs in the oil industry. This dramatically reduced the quality of labor in Florida and quickly led to increased labor costs and decreased efficiency in the years to follow. So, while it can be painful to see where construction costs are today, history indicates that they will not be dramatically reduced in the years to come regardless of economic pressures.

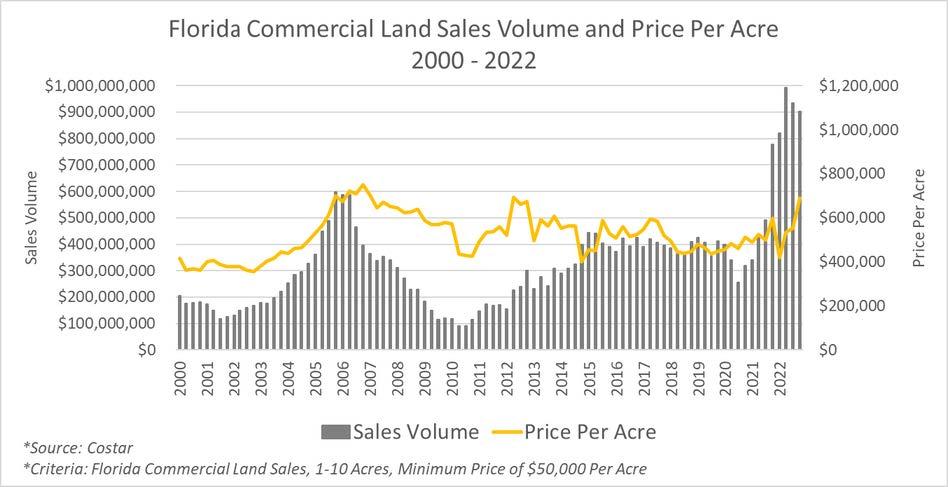

Land Prices

Land prices are another major contributor to the cost of a new facility. The below chart exhibits the sales volume and price per acre of commercial land sales in Florida from 2000 through 2022. Although sales volume fell dramatically following the Great Financial Crisis in 2007-2008, prices remained much more resilient.

As demonstrated by history, land prices are often less vulnerable to dramatic swings as other sectors of the economy, and it may be unrealistic to expect land prices to decrease in a significant way in the years to come. Furthermore, Florida land prices may be particularly resilient given the incredible population and economic growth the state has experienced since the beginning of the pandemic. Florida was the fastest growing state in the U.S. in 2022 with nearly 1,000 people per day moving to the Sunshine State. Additionally, according to IRS data analyzed by SmartAsset, households making over $200,000 moved to Florida at four times the rate of any other state, which continues to fuel demand and strengthen the State’s economy.

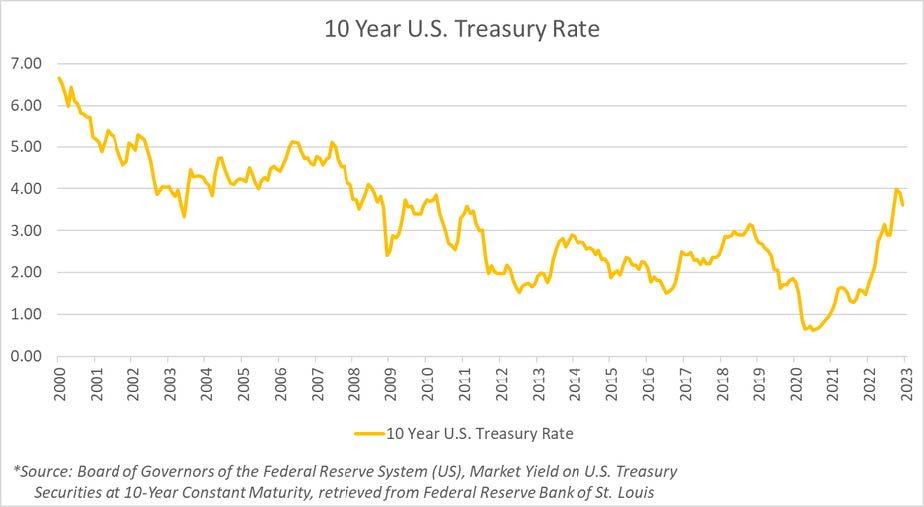

Interest Rates

Interest rates are another key factor in determining the cost of a new medical facility project. The below chart illustrates the recent trend of the 10 Year U.S. Treasury Rate, which serves as a vital economic benchmark and influences many other interest rates including mortgage rates and other borrowing rates. Just like a mortgage rate on a home, the interest rate for a commercial project directly effects the cost of ownership and is inversely correlated with the returns of a given project all else being equal. While interest rates are not particularly elevated from a historical perspective, they have dramatically increased from the low interest rate environment during the post-pandemic period and through most of 2022. Interest rates have historically been very difficult to predict.

Moving Forward

Where Do We Go From Here?

If history tells us anything, it is extremely difficult to time the market, and prices are often much stickier than people anticipate or remember. As such, we advise our clients to focus on the strategy and operations of the business, and how a new facility will impact the entire operations, rather than focus solely on the costs and trying to time the construction of a needed facility. We recently discussed the benefits of taking a holistic approach to healthcare real estate in a recent article titled Value Per Square Foot: A New Way of Thinking About Healthcare Delivery and Real Estate.

The good news is that once a provider has decided that a new facility will be beneficial to the operations and fits within the business plan, there are several structures available to reduce the upfront capital requirement and help lower the burden of higher construction costs. These can include but are not limited to:

1. Working with an Experienced Developer To:

Land parcel: Not all parcels are created equally. It is now more important than ever to work with an experienced team to identify the right parcel, perform the proper due-diligence, and negotiate favorable terms.

Manage costs: Given the cost environment, providers must be careful not to “overbuild” their ambulatory facilities. A sound budget requires deep knowledge and experience developing outpatient medical facilities. Additionally, many developers, including Optimal, will guarantee the cost of the project early in the process to help avoid cost escalations as the project commences.

Stay on schedule: Time is money, and providers must focus on efficient decision making to avoid costly project delays. It is important to partner with developers and construction teams that have the knowledge/experience to keep the project moving (ordering materials ahead of time, storing lead time items, knowing how to navigate regulatory authorities, etc.). This also requires deep relationships with vendors in order to be able to leverage those relationships on behalf of the client.

2. Build-to-suit or joint-venture partnerships

Build-to-suit: The least capital-intensive financial structure for a tenant is entering into a lease agreement with a developer (a “build-to-suit”). In this instance, the tenant is not responsible for any equity contributions to fund the shell building. Rather they are only responsible for a lease payment for the term of the build-to-suit agreement (typically 10 – 20 years), and a portion of the cost of the interior buildout.

Joint-venture: A joint-venture can allow provider(s) to have exposure to the potential investment upside of a successful healthcare real estate project without many of the time-consuming or burdensome tasks associated with real estate ownership. In a JV partnership scenario, some developers such as Optimal will fund the majority of the development costs including securing the financing with no guaranties required from individual investors within the provider group.

3. Strategic Financing

Strategic Financing: Given the rising interest rate environment, borrowers must be diligent in securing the right financing for a project. Working with a partner that has existing banking relationships and a track record of successful projects can help ensure the most attractive financing terms. In addition, experienced borrowers can ensure that the loan documents provide maximum flexibility to allow for loan restructuring or refinancing when appropriate.